Oct 15, 2020

Research Publication

State-level TANF Policies and Practice May Shape Access and Utilization among Hispanic Families

Authors:

Overviewa

Temporary Assistance to Needy Families (TANF) is a federally funded program with powerful potential to support families’ economic needs by providing cash assistance or other services that satisfy one of its four purposes (see text box). Under TANF, the federal government provides states with block grants that give them authority to allocate funds as long as federal

purposes are met. States have the flexibility to develop their own policies and practices that can affect program eligibility and individual’s experiences with accessing and maintaining support from TANF cash assistance. Additionally, states have discretion in the extent to which counties—and, in some cases, cities—have decision-making authority over how TANF funds are administered.

TANF cash assistance supports a small portion of potentially eligible families; in 2018, less than one quarter of families living in poverty received TANF cash assistance.1 Even though receipt is higher among eligible children (as child-only cases), 35 percent of children in poverty—including 45 percent of children in deep poverty—who were eligible for TANF cash assistance did not receive it.2 Notably, although important for families, TANF cash benefits typically are not enough to move families above the poverty line. In 2018, the national average monthly cash benefit received by families was $423;3 however, the national average monthly income threshold for the federal poverty level (FPL) was $1,011 for one person and $1,732

for a family of three.4

Hispanics comprise 18 percent  of the national population,5 but represent a disproportionate share of individuals in poverty (26%).6 According to estimates from the 2018 American Community Survey, 5.8 percent of foreign-born and 7.2 percent of U.S.-born Hispanic child households reside in deep poverty (<50% of FPL); 14.3 percent and 10.3 percent, respectively, reside in medium poverty (50-99% of FPL); and 34.0 and 23.0 percent, respectively, reside in near poverty (100-199% of FPL).7 The extent to which states provide cash benefits to children in poverty varies substantially. In 2014, TANF cash assistance, on average, was provided to fewer than 8 families for every 100 with children in poverty in Arizona, North Carolina, and Texas, and for at least 40 families for every 100 with children in poverty in California and New York.8

of the national population,5 but represent a disproportionate share of individuals in poverty (26%).6 According to estimates from the 2018 American Community Survey, 5.8 percent of foreign-born and 7.2 percent of U.S.-born Hispanic child households reside in deep poverty (<50% of FPL); 14.3 percent and 10.3 percent, respectively, reside in medium poverty (50-99% of FPL); and 34.0 and 23.0 percent, respectively, reside in near poverty (100-199% of FPL).7 The extent to which states provide cash benefits to children in poverty varies substantially. In 2014, TANF cash assistance, on average, was provided to fewer than 8 families for every 100 with children in poverty in Arizona, North Carolina, and Texas, and for at least 40 families for every 100 with children in poverty in California and New York.8

A variety of demographic characteristics related to the citizenship status of Hispanic family and household members, family and household composition, and language fluency may affect program eligibility, access, and utilization. For example, Hispanic families are more likely than non-Hispanic families to be residing with at least one non-U.S.-born parent (50%),9 an unrelated adult (27%),10 and an adult who is not verbally proficient in English (37%).11

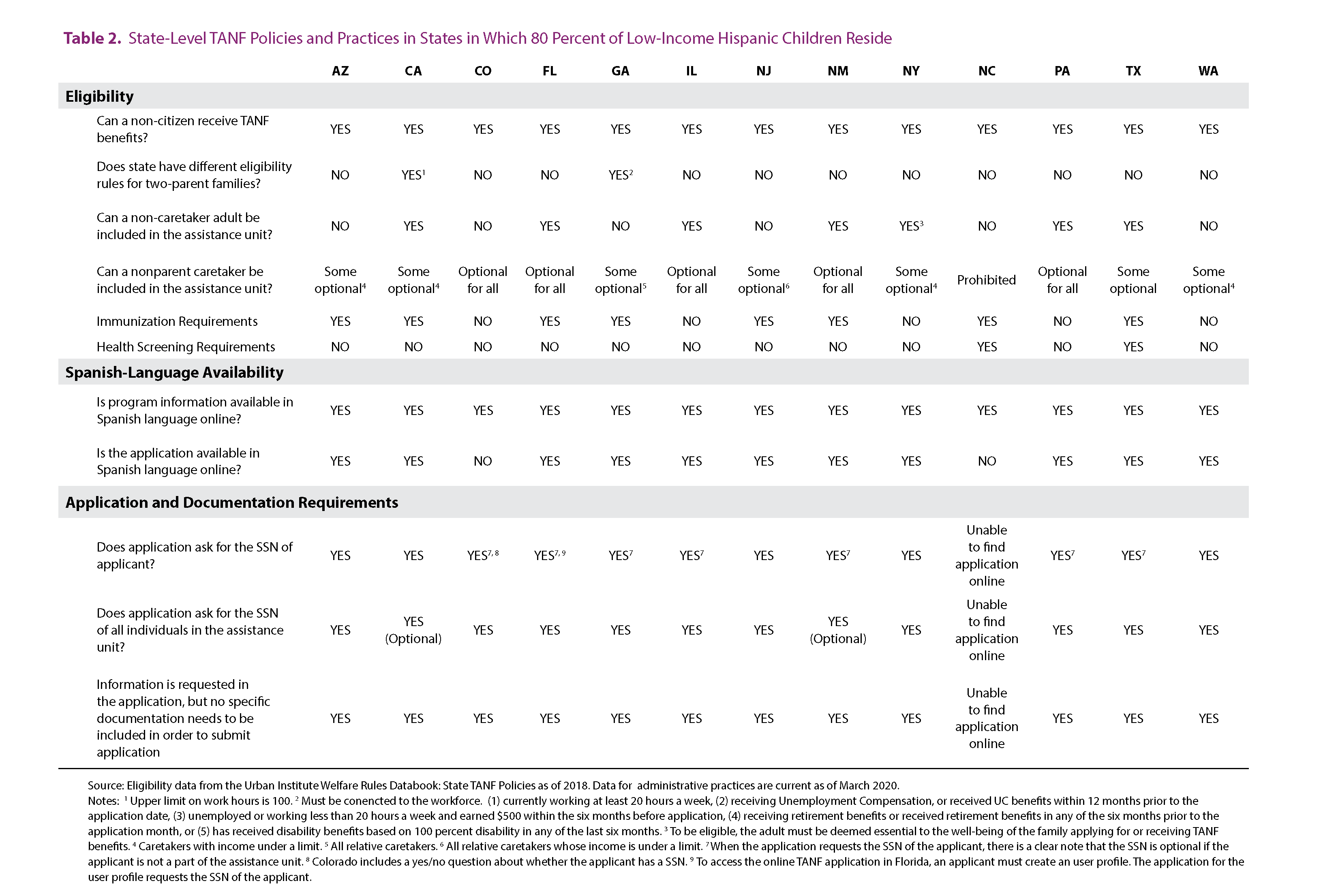

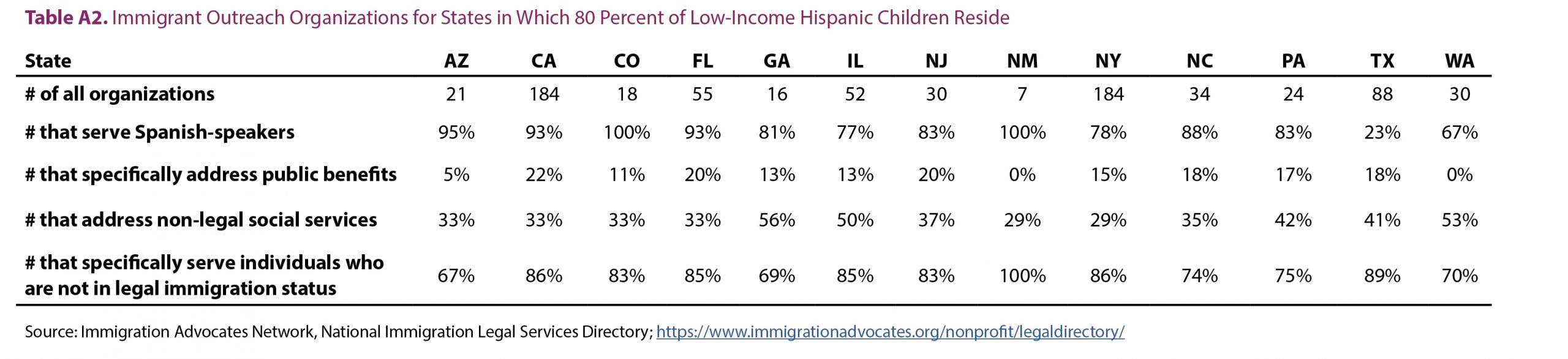

This brief describes state-level policies and administrative practices for TANF that may influence income-eligible Hispanic families’ use or non-use of the cash assistance component of the TANF program.b Our analysis focuses on the 13 states that are home to over 80 percent of all Hispanic children living in low-income (<200% FPL) households in the United States, as of 2016.12 We first provide some detail on the demographic characteristics of the 3 states studied and describe how each state allocated TANF funds. We then describe four provisions of TANF cash assistance policies that determine 1) the eligibility of individuals who are authorized non-citizens; 2) eligibility based on family structure; 3) eligibility of household members who are not part of the immediate family; and 4) whether health status screening is required to maintain eligibility (e.g., immunizations). We also describe administrative practices related to 1) the information requirements in the application form; and 2) the linguistic accessibility of program information and whether an application is available online. Data were collected using publicly available data sources capturing TANF policies and practices prior to March 2020.

Key Findings

The 13 states studied—Arizona, California, Colorado, Florida, Illinois, North Carolina, New Jersey, New Mexico, Pennsylvania, Texas, and Washington—shared many of the same eligibility policies and administrative practices examined in this brief. It is likely that more than the examined policies and practices explain the wide variation in actual TANF cash assistance utilization among Latino families across these same 13 states.

Nevertheless, several examined policies and practices across states interact with demographic characteristics more common among Hispanic families in a way that may support access to TANF cash assistance, such as the high prevalence of information and application materials in the Spanish language. However, other policies and practices may discourage access—especially documentation practices and eligibility requirements around citizenship status.

Policies around eligibility

Citizenship status. Non-citizens are authorized to receive TANF, but eligibility criteria vary across states. Each of the 13 states allow individuals who are authorized non-citizens to receive TANF benefits, which could help Hispanic families—who are more likely than non-Hispanic families to have a member who is an authorized non-citizen13—to access the program. However, eligibility varies across states based on when the individual arrived in the United States, the individual’s legal status upon arriving in the United States, and the number of years of residency in the United States.

Family structure. Extra work requirements rules apply to two-parent families in two of the 13 states. These may be more likely to affect Hispanic families, who have a relatively high prevalence of two-parent households.14

Household composition. Non-caretaker adults (e.g., extended family members or boarders) are not always considered part of the assistance unit. Six of the 13 states do not allow a non-caretaker adult to be included in the assistance unit (i.e., individuals in the household applying to receive TANF benefits), and one state does not allow a non-parent caretaker to be included in the assistance unit.c These policies could have differential impacts on Hispanic families, who are more likely than non-Hispanic families to live in a household with an unrelated adult.15

Health status screening. Some states have immunization and health screening requirements as part of eligibility determination. Eight of the 13 states examined here have immunization requirements and two states have health screening requirements. Hispanic families are more likely than non-Hispanic families to be uninsured, and thus may be less likely to meet these health requirements.16

Administrative practices

Although nearly all states offered an option to apply for TANF basic cash assistance online—a format that can ease burden—substantial variation in the eligibility and documentation requirements related to residing household members, SSNs, and reporting of information to immigration services may still present barriers for Hispanic applicants. On the other hand, the availability in Spanish of information on the TANF program, and the availability of a Spanish-language TANF application across most states, can facilitate access for Hispanic families.

Application information requirements

- One state, North Carolina, did not have an online TANF cash assistance application. The remaining 12 states with an online TANF cash assistance application requested the social security number (SSN) of the applicant (i.e., the individual completing the form) and of the individuals in the assistance unit. For seven of these states, the application stated up-front that the SSN is optional if the applicant is not part of the assistance unit. In the remaining five states, this detail was located in a different section of the application. Requests for a SSN could deter Hispanic families, who are more likely than non-Hispanic families to have non-citizen household members.17

- All 12 states with an online TANF application required applicants to provide contact information for all members of the household, regardless of whether household members were applying for assistance. Requests for contact information for all household members could deter Hispanic families, who are more likely than non-Hispanic families to have non-citizen and unauthorized household members.18

- Four states explicitly note that they will not share information with the United States Citizenship and Immigration Services (USCIS) about household members who are non citizens and are not included in the assistance unit, while four states indicate that they may share information. The five remaining states did not specify whether they would share this information; this uncertainty may discourage use of TANF cash assistance among Hispanic families, who may fear identifying undocumented individuals who live with them or near them.

Spanish-language availability of program information and application

- Information on the TANF cash assistance program was available in the Spanish language for all 13 states, which facilitates learning about the program for individuals who are more proficient in Spanish than in English.

- Eleven of the 13 states provide a TANF cash assistance application online in the Spanish language, which can reduce the administrative burden for individuals who read Spanish more proficiently than they read English.

Background

Characteristics of the 13 study states

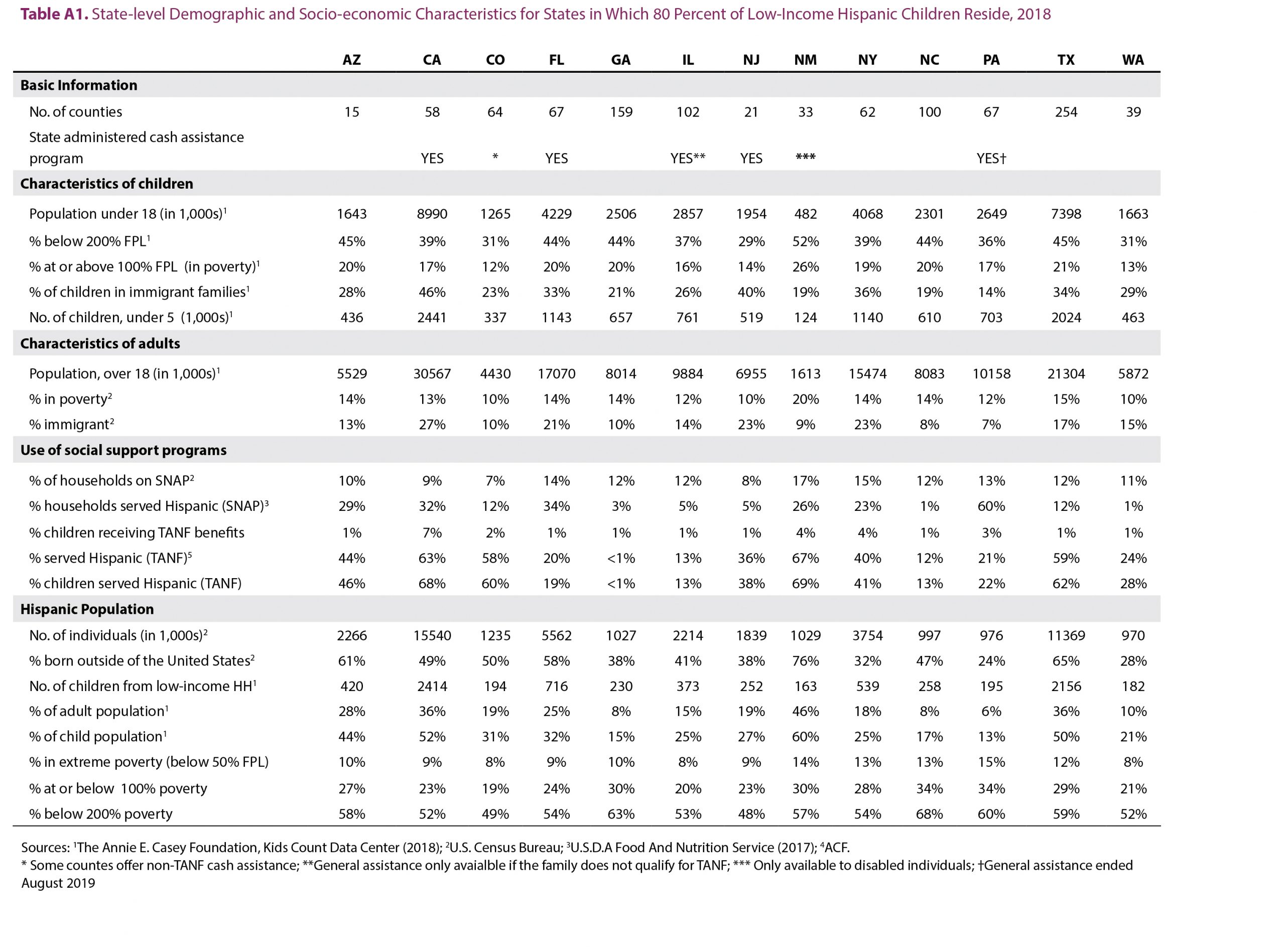

The 13 states included in this study are home to 80 percent of the low-income Hispanic child population in the United States.19 Table A1 (see Appendix, pg. 12) presents selected descriptive demographic, poverty, and program utilization characteristics of these 13 states.

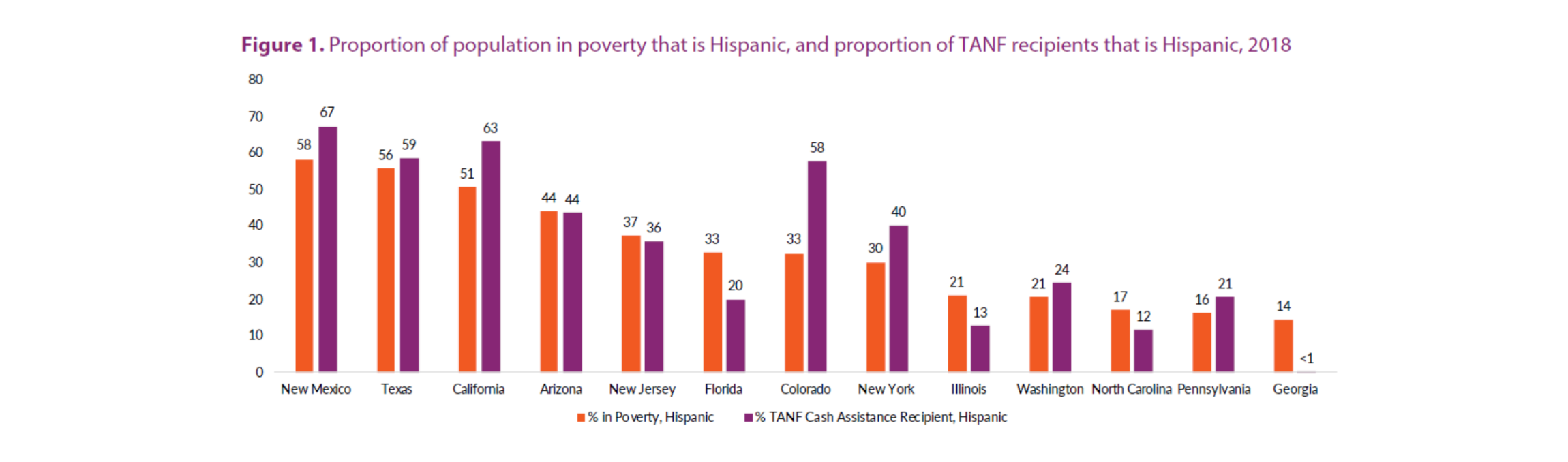

While not all individuals living in poverty are eligible for TANF cash assistance, Figure 1 provides evidence of the variation in TANF use by potentially eligible Hispanic people across the 13 states. Specifically, the figure shows the proportions, in each state, of (a) those in poverty who are Hispanic, and (b) TANF cash assistance recipients who are Hispanic. The share of individuals in poverty who are Hispanic varies across the 13 states, from a high of 58 percent in New Mexico to a low of 14 percent in Georgia. The share of TANF recipients (across various TANF-funded programs) who are Hispanic also varies across states, from a high of 67 percent in New Mexico to a low of less than 1 percent in Georgia. In five states (Florida, Georgia, Illinois, New Jersey, and North Carolina), the percentage of individuals in poverty who are Hispanic is greater than the percentage of TANF recipients who are Hispanic. In other words, fewer Hispanic people are receiving TANF cash assistance than Hispanics’ share of the population in poverty would suggest. In seven states (California, Colorado, New Mexico, New York, Pennsylvania, Texas, and Washington), the percentage of TANF recipients who are Hispanic is greater than the percentage of individuals in poverty who are Hispanic—in other words, more Hispanic people are receiving TANF than their share of the population would suggest. In one state, Arizona, the percentage of TANF recipients who are Hispanic is the same as the percentage of individuals in poverty who are Hispanic.

How the 13 States allocate TANF funds

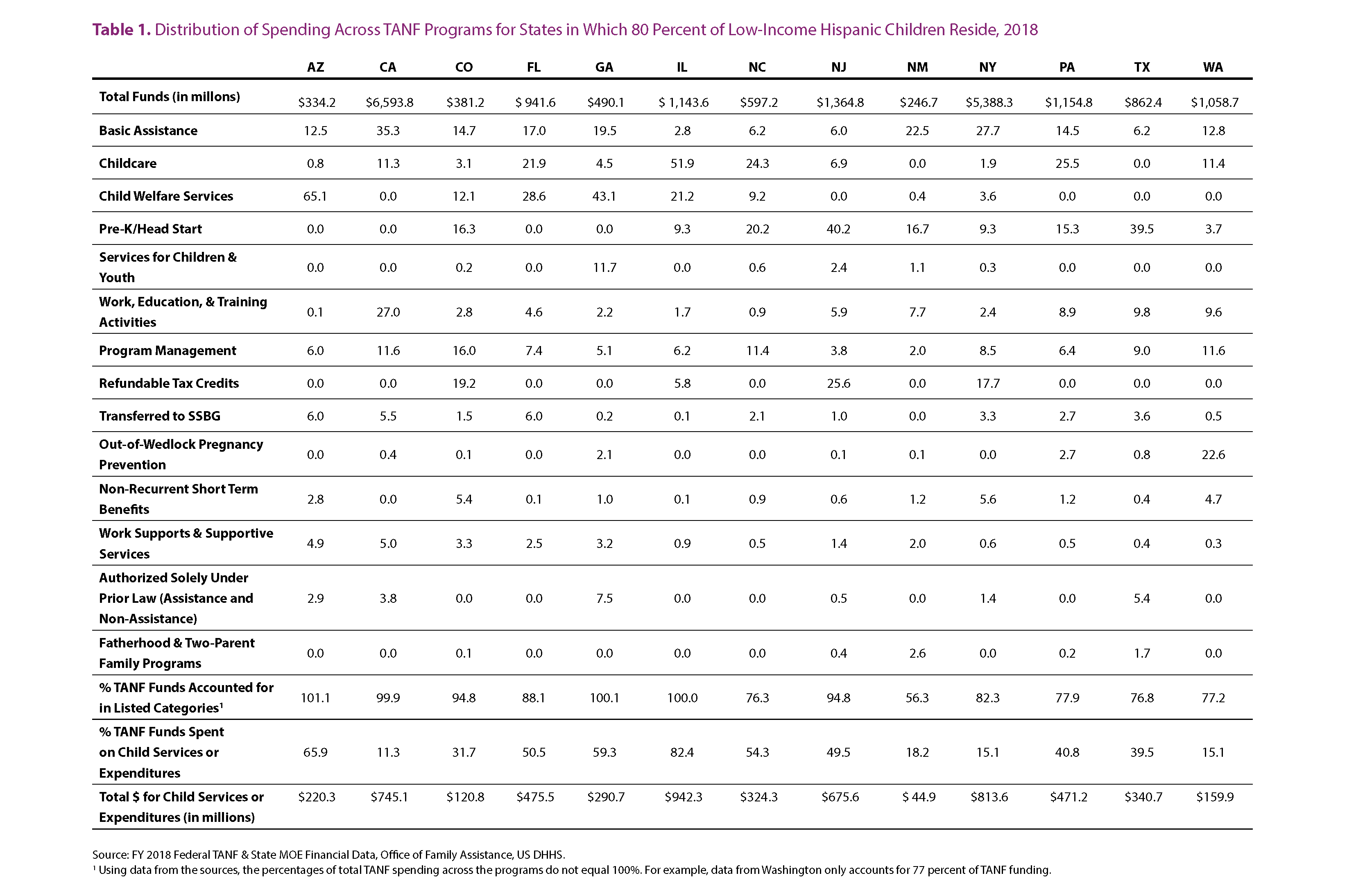

TANF funds go toward a range of supports and services. In 2018, federal expenditures for TANF totaled $31.3 billion and served 3.2 million recipients, with funding allocated to basic cash assistance, child care, pre-K/Head Start, child welfare, education and training, refundable tax credits, and emergency and short-term benefits.20,21 Nationally, 21 percent of all TANF funding in 2018 was directed to cash assistance programs.22 However, the way in which individual states distribute TANF funding varies (see Table 1). In 2018, only three of the 13 states examined spent more than the national average on cash assistance—California (35%), New Mexico (23%), and New York (28%). Interestingly, these three states also show a higher rate of Hispanic families utilizing cash assistance than their representation among the population in poverty would suggest (see Figure 1). The remaining states spent less than the national average on their cash assistance programs.

States’ choices to allocate funding to one type of program eligible for TANF implies less funding for other programs eligible for TANF support. For example, Illinois spent a low of 3 percent on its basic cash assistance program, while California spent a high of 35 percent. However, Illinois allocated 82 percent of its TANF funding to child-related programs (i.e., child care, child welfare services, pre-K/ Head Start, and services for youth and children), while California allocated only 11 percent to child-related programs. Child-related programs accounted for at least half of TANF expenses in five of the 13 states. On the high end, Illinois spent over 80 percent of its TANF dollars on child-related programs. On the low end, California, New York, New Mexico, and Washington spent less than 40 percent of their TANF dollars on child-related programs. It is difficult to assess whether these TANF-based, child-related program investments reflect an overall improvement, as monies may be substituted from other sources to result in no net increase. However, some TANF-based, child-related programs provide in-kind resources to families, which can also improve child development, family functioning, and well-being.

A Theoretical Framework: How Policy and Practice Can Shape Utilization of TANF Cash Assistance

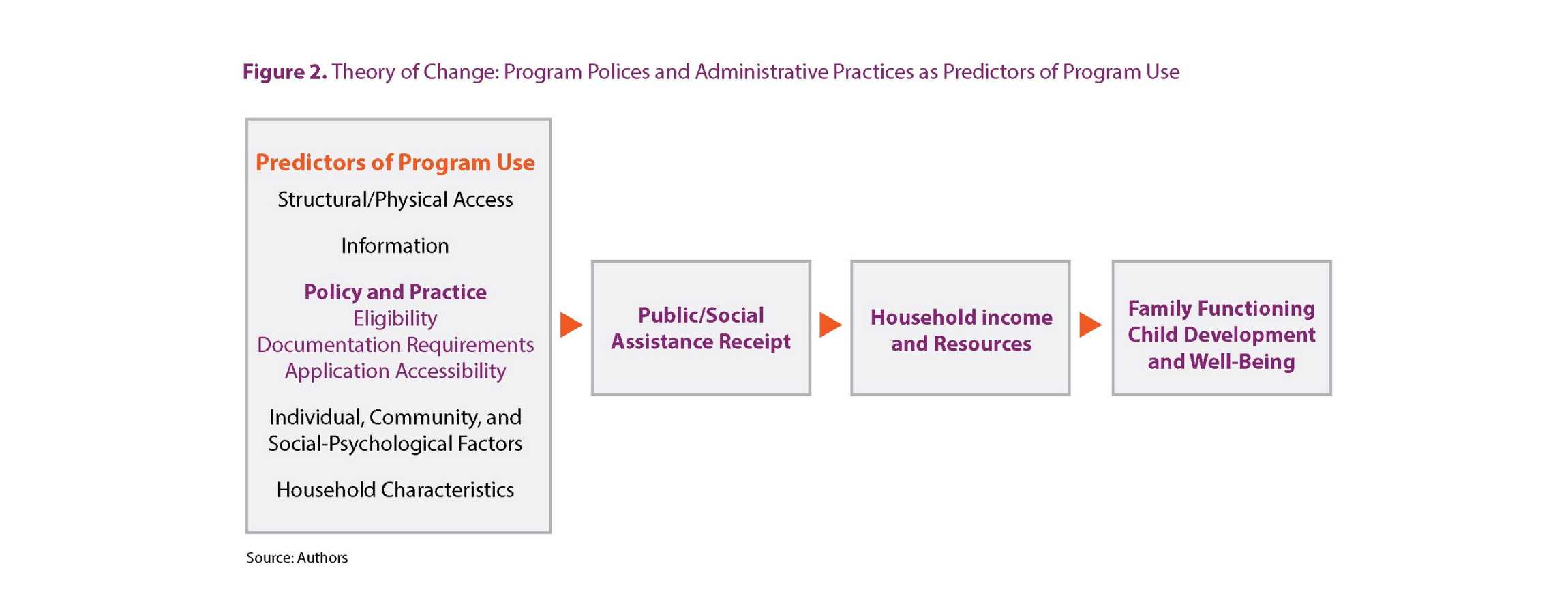

The analyses presented in this brief are informed by the theory of administrative exclusion that describes how policymakers’ and program administrators’ decisions regarding program eligibility, information accessibility, and application requirements shape who is excluded or included in the receipt of program benefits.d

Figure 2 presents a broad heuristic theory of change, showing how social support programs may affect the lives of low-income Hispanic children and families. Social support programs increase household income and resources with the ultimate goal of improving child development, family functioning, and child and family well-being. The figure highlights the role of program policies and administrative practices as predictors of program use.

A more detailed conceptual framework for identifying racial and ethnic disparities in human service delivery, developed by the Urban Institute, demonstrates how racial and ethnic disparities may present along different points in service delivery.22 Notably, differences in the rate of service use alone may reflect (for example) differences in eligibility, and not constitute inequity (i.e., inequitable differences among eligible families).23

Data Sources

Data on state policies and administrative practices regarding the TANF cash assistance program came from two sources. First, policy data came from the 2018 Urban Institute Welfare Rules Databook: State TANF Policies.24 Data for the policy review are current as of July 2018.

Second, data on the administrative practices for state-level TANF cash assistance programs were collected through a qualitative user experience review. Researchers visited the websites of human service and income maintenance state agencies tasked with delivering their respective TANF cash assistance programs to simulate the online application experience in each state. Researchers assessed the availability of TANF program information and an application online in the Spanish language. Researchers also reviewed the information requested in application forms and catalogued whether social security numbers (SSNs) and additional information were requested, and for whom. Data for the administrative practice review are current as of March 2020.e

Findings: State Policies Around Eligibility for TANF Cash Assistance

States establish a variety of financial and non-financial requirements that determine initial and continued eligibility for TANF cash assistance. Below (and in Table 2) is a summary of the requirements likely to interact with demographic characteristics more common among Hispanic families, which may therefore impact Hispanic families’ utilization of cash assistance.

Citizenship status

All 13 states allow someone who is an authorized noncitizen to receive TANF benefits. However, across the 13 states, eligibility varies depending on when an authorized non-citizen immigrated to the United States—specifically, on whether they immigrated before or after the passage of the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) in 1996. Policies related to the eligibility of non-citizens may differentially impact utilization of TANF cash assistance; half of all Hispanic families with children include at least one parent who immigrated to the United States, and one in four Hispanic children have at least one parent who has an unauthorized citizenship status in the United States.25

For non-citizens who immigrated pre-PRWORA: In 12 of the 13 states, non-citizen lawful permanent residents (LPR)f and asyleesg who arrived pre-PRWORA (i.e., before August 22, 1996) are eligible for cash assistance. In Arizona, asylees who arrived pre-PRWORA are eligible for cash assistance, but LPRs must have five years of lawful residency, a prior qualified status, a military connection, or continuous residency to be eligible for cash support (data not shown).

For non-citizens who immigrated post-PRWORA: In seven states—Arizona, Colorado, Florida, Illinois, New Jersey, North Carolina, and Texas—LPRs who arrived in the United States post-PRWORA (i.e., after August 22, 1996) are not eligible for cash assistance during their first five years of residence in the United States. Additionally, in Texas, LPRs who arrived post-PRWORA and have five years of residency in the United States must also have 40 qualifying quarters of work to be eligible for cash assistance. In the remaining six states (California, Georgia, New Mexico, New York, Pennsylvania, and Washington), LPRs who immigrated to the United States post-PRWORA are eligible for cash assistance within their first five years of residency. Texas is the only state among the 13 examined for this study in which asylees and refugees who arrived post-PRWORA are categorically ineligible for cash assistance (data not shown).

Family structure

Two of the 13 states have different eligibility rules based on family structure. California and Georgia have different rules for households with two parents than for households with one parent. California imposes an upper limit of 100 hours on parents’ work, while Georgia requires that at least one parent be connected to the workforce. These requirements, only imposed on two-parent families, could differentially impact Hispanic families: 66 percent of all Hispanic children live in a two-parent home, which is less than the 77 percent of non-Hispanic White children but a higher percentage than the 37 percent of non-Hispanic Black children.26 Based on analyses from 2013, Hispanic families make up just over half of two-parent households receiving TANF cash assistance.27

Household composition

Seven states allow a non-caretaker adult to be included in the assistance unit (i.e., the members of a household included on the TANF cash assistance application whose needs are considered when determining the amount of cash support). The seven states that allow non caretaker adults to be included in the assistance unit only allow certain categories of individuals to be included. Florida, New Mexico, Pennsylvania, and Texas only allow relatives to fall within this category, while California only allows registered domestic partners, Illinois allows only civil union partners, and New York allows all adults deemed essential to the well-being of the family. The other six states (Arizona, Colorado, Georgia, New Jersey, North Carolina, and Texas) do not allow non-caretaker adults to be included in the assistance unit. This policy could differentially affect the amount of cash assistance that benefits recipient families because over 25 percent of low-income Hispanic child households include an unrelated adult—similar to the 28 percent of non-Hispanic White child households that include unrelated adults but less than the 15 percent of non-Hispanic Black child households.28

Twelve of the 13 states allow a non-parent caretaker to be included in the assistance unit. North Carolina is the only one of the 13 states examined that prohibits non-parent caretakers from eligibility in the assistance unit. Among the remaining 12 states, Arizona, California, New York, and Washington require that the caretaker have income under a designated limit; in Georgia and Texas, the caretaker must be a relative; in New Jersey, the caretaker must be a relative and have income under a designated limit; and Colorado, Florida, New Mexico, and Pennsylvania provide no specific guidelines for the caretaker. This policy could differentially impact the amount of cash assistance that families receive because over 25 percent of low-income Hispanic child households include an unrelated adult.29

Health status screening

Eight states have requirements for immunizations for children and two states have health screening requirements for children and adults. Arizona, California, Florida, Georgia, New Jersey, New Mexico, North Carolina, and Texas require child immunization either for initial eligibility or continued program eligibility. These states may not require parents to submit immunization records and could instead require that applicants sign a contract of compliance. Similarly, North Carolina and Texas require that applicants attest to having health screenings, although states may not require records to verify. Nonetheless, requirements to interact with health care institutions could differentially affect families’ eligibility since 21 percent of Hispanics under age 65 do not have health insurance, compared to 8 percent of non-Hispanic Whites and 12 percent of non-Hispanic Blacks.30

Findings: State Administrative Practices Related to TANF Basic Cash Assistance

Spanish-language support

All 13 states provide information on the TANF cash assistance program in the Spanish language as part of their state-sponsored websites. The availability of program information in Spanish can reduce the burden for learning more about the program for individuals who read the Spanish language. Almost two thirds of first-generation Hispanics report that they cannot read English “very well” or “pretty well”; however, more than 90 percent report reading  Spanish “very well” or “pretty well.”31

Spanish “very well” or “pretty well.”31

Eleven of the 13 states provide a TANF cash assistance application online in the Spanish language. North Carolina was the only state without an online application for cash assistance, irrespective of language. Colorado provided the application online in English, but not in Spanish. The provision of an application in Spanish could reduce the administrative burden for individuals who read Spanish.

Information requested in the online application form

The 12 states that provide an online TANF application request the social security number (SSN) of the applicant and of all members of the assistance unit. In seven of these 12 states (Colorado, Florida, Georgia, Illinois, New Mexico, Pennsylvania, and Texas), the application form also states up-front that the applicant (i.e., the individual completing the form) does not need to provide a social security number if the applicant is not included in the assistance unit. Despite this statement, in Florida, access to the TANF online application requires the applicant to create an online profile, which does request a SSN. The remaining five states (Arizona, California, New Jersey, New York, and Washington) instruct applicants that the SSN is optional if the applicant is not in the assistance unit; however, these instructions are located in a separate section of the application form. Waiving the requirement to provide a SSN for applicants who are not in the assistance unit allows parents who do not have SSNs to apply for cash assistance benefits on behalf of their citizen child(ren).

This policy could help Hispanic families access TANF since half of all Hispanic families with children have at least one parent who immigrated to the United States, and one in four Hispanic children have at least one parent who has an unauthorized citizenship status in the United States.32

In their application forms, two states suggest that they might share program applicants’ information with law enforcement authorities. Arizona’s application system includes a note that they will not report any family member to United States Citizenship and Immigration Services (USCIS) unless they are informed that a person is in the country illegally. Similarly, Georgia does not (by law) submit contact information and immigration status to USCIS—but the state ambiguously warns that “this information (i.e., SSN, names and address) may also be given to law enforcement officials to use to catch people who are running from the law.”

The 12 states with an online TANF application request that applicants list all household members on the application. These 12 states generally request information on the name, gender, birthdate, relationship to applicant, and marital status of all members of the household. States vary in the guidance they provide on the online application with respect to listing SSNs (or comparable documentation of U.S. citizenship of household members), as well as how that information will be used. For example, Arizona states, “We will not report you, a family, or a household member to the US Immigration and Customs Enforcement (ICE) unless you inform us that you, your family, or a household member is in the US illegally.” New Mexico states that SSNs are only required for “household members applying for assistance” and that “the immigrant status on all individuals applying for benefits is subject to verification by the Department of Homeland Security…and the information received from DHS may affect your household’s eligibility and benefits.” Requesting information for all members of the household—even those not included in the assistance unit— may disproportionately deter Hispanic applicants who live with a non-citizen household member, as could the challenges of deciphering the legal or technical language used to describe the implications of reporting SSNs.33

Additional dimensions of the online application experience

The 12 states with an online TANF application use a combined application form for TANF and other social support programs, which streamlines the benefit process. However, the more stringent program eligibility requirements seen in some states’ TANF applications may deter applicants to other programs with less stringent eligibility requirements.

Seven of the 13 states provide accommodations (e.g., phone help, interpreters, consultants, modification of application) for applicants with different needs; these accommodations may also benefit Hispanic applicants with low levels of English literacy.

None of the 12 states with an online TANF application require applicants to submit documentation in support of their application at the point of submission. However, supporting documents (e.g., pay stubs, bank statements) could be required at a later stage in the application process—for example, during the interview. This study did not include an assessment of requirements after the online application process.

Discussion

In this brief, we examined the 13 states that are home to 80 percent of all Hispanic children in low-income households, documenting (based on publicly available information) state policies around TANF cash assistance eligibility determination and state administrative practices. We find that a variety of the eligibility policies and administrative practices we examined are likely to interact with demographic characteristics that are more common among Hispanic families. Some interact favorably, such as widespread availability of Spanish-language translation and related accommodations to support low literacy in English or other languages. Other dimensions interact less favorably, such as complicated criteria related to citizenship status, documentation of SSNs, and work hour and related eligibility differences for two-parent families.

In the absence of evidence for the direct impact of cash assistance policies and practices on program use, program data are only one signal to states for whether cash assistance and other TANF programs are being equitability accessed by eligible families. The 1996 PRWORA legislation drastically reformed the TANF cash assistance program with the intent of reducing families’ reliance on the program and promoting “personal responsibility” through employment. Some scholars expressed concern that the resulting PRWORA legislation would likely generate long-standing unintended consequences for many U.S.-born eligible families and children.34,35 These concerns are borne out in our findings and research, which reflect how state policy provisions have injected avenues allowing for discrimination into TANF’s administration.

Do the examined policies and practices appear to relate to access and utilization of TANF basic cash assistance? Overall, across the 13 states we examined, our study uncovered more similarity and agreement than variation in policy and practice. Thus, given the heterogeneity in actual utilization of TANF basic cash assistance among Hispanic families, this implies that other factors beyond the policies and administrative practices examined here likely influence Hispanic family access and utilization. Such factors may include the difficulty of capturing chilling effects that are due to anti-immigrant sentiment and enforcement, or the difficulty of measuring uptake of state- and local-based cash support that is not TANF-funded. Further, it was not feasible to isolate the extent to which Hispanic families and children may benefit (or not) from TANF programs apart from cash-based assistance, such as early care and education, refundable tax credits, and other services.

Patterns of program utilization do not have a descriptive one-to-one alignment with states’ policies and practices. The comparison of the share of the population in poverty that is Hispanic (a proxy measure of income-eligible individuals) and the percentage of TANF cash assistance recipients who are Hispanic show that some of the 13 states have disproportionately higher rates of program participation by Hispanic families, while others have disproportionally low rates. Patterns of utilization based on whether states are host to an emerging or an established Hispanic populationsh—or whether states have higher (>20%) or lower (<20%) proportions of the Hispanic population that are not U.S.-borni—also do not clearly align with the policies and practices examined here. Further empirical research is needed to examine how state-level policies and practices affect program use (see Figure 2).

States are required to submit a TANF state plan to the federal government every two years. The development of this plan provides states the opportunity to evaluate the existing policies and practices that govern access to their TANF programs, as well as the allocation of monies toward cash assistance. While devolution of authority to states and localities allows decision makers to tailor allocation of funds in ways that optimize the needs of their local populations, it also leaves funding vulnerable to shifts in policy priorities that may be unsupportive of families, or of families that belong to certain demographic groups. Many states and localities have also moved toward one-stop gateway systems or portals to determine eligibility and subsequent confirmation of receipt for multiple government benefits, including child care subsidies and food stamps. For efficiency reasons, these portals may default to the most restrictive versions of eligibility. As a public benefit with (potentially) the most complex and restrictive criteria for eligibility,36 defaulting to TANF criteria may unintentionally restrict or limit gateways to other benefits for which families may nonetheless be eligible; this may result in varied utilization across a range of public benefits among Hispanic families. (See analysis of Hispanic families’ use of CCDF.)

The impact of COVID-19 on low-income families highlights the importance of public programs and mechanisms to provide income support.37 As public health guidelines limit in-person contact, innovations in digital and alternative outreach for reaching families represent a moment in which administrative burdens can be revisited in ways that support Hispanic families and people of color who have been disproportionately impacted by COVID-19.38 For example, such support might include the removal of any health status screening requirements that are unnecessarily punitive for families who are already vulnerable because of being uninsured. Even if TANF funding continues to be directed toward programs other than cash assistance that might have previously benefited Hispanic families and children, COVID-19 has made clear that TANF basic cash assistance in its present form is not likely to be adequate as a cash safety net.

Footnotes

a This research was made possible by a research grant to principal investigator Lisa Gennetian from the WT Grant Foundation and grant number 90PH0028 by the Office of Planning, Research, and Evaluation, Administration for Children and Families, U.S. Department of Health and Human Services for the National Center for Research on Hispanic Children & Families. We use the term “Latino” interchangeably with “Hispanic.”

b Federal TANF dollars are allocated as long as the activities or services fall within one of the four purposes—including, for example, early childhood education and care. This brief focuses solely on how TANF dollars are allocated to cash assistance.

c Individuals can live in households with others who apply to receive TANF benefits, and not themselves apply to be part of the assistance unit.

d For a more thorough description of the underlying theory building on the idea of administrative burden, see Hill, Z., L.A. Gennetian, and J. Mendez (2019). A descriptive profile of state Child Care and Development Fund policies in states with high populations of low-income Hispanic children. Early Childhood Research Quarterly 47(2): 111-23. States allocate a different amount of funds to a variety of categories, including (1) basic assistance, work, education, and training activities; (2) child care (spent/transferred); (3) program management; (4) refundable tax credits; (5) child welfare Services; (6) Pre-K/Head Start; (7) transferred to Social Services Block Grant; (8) out-of-wedlock pregnancy prevention; (9) non recurrent short-term benefits; (10) work supports and supportive services; (11) authorized solely under prior law; (12) services for children and youth; and (13) fatherhood and two-parent family programs.

e Reviews of state lead agency websites were conducted in January 2020. As such, findings reflect information and applications available before the COVID-19 pandemic may have impacted the program information provided on state websites.

f Lawful permanent residents are immigrants who have been authorized to permanently live and work in the United States.

g Asylees are immigrants who flee their countries due to persecution because of race, religion, nationality, political opinion, or membership in a social group, and who later request permission to remain in the United States.

h Emerging Hispanic population states are Colorado, Georgia, North Carolina, Pennsylvania, and Washington. Established Hispanic population states are Arizona, California, Florida, Illinois, New Jersey, New Mexico, New York, and Texas.

i States where higher (>20 percent) proportions of the Hispanic population are foreign-born are California, Florida, New Jersey, New York, and Texas. States where lower proportions of the Hispanic population are foreign-born are Arizona, Georgia, Illinois, New Mexico, North Carolina, Pennsylvania, and Washington.

Suggested Citation

Gennetian, L. A., Hill, Z., & Ross-Cabrera, D. (2020). State-level TANF Policies and Practice May Shape Access and Utilization among Hispanic Families. Report 2020-06. Bethesda, MD: National Research Center on Hispanic Children & Families. Retrieved from www.hispanicresearchcenter.org/research-resources/state-level-tanf-policies-and-practice-may-shape-access-and-utilization-among-hispanic-families

References

1 Floyd, I. (2020). Policy Brief: Cash Assistance Should Reach Millions More Families. Washington, D.C.: Center on Budget and Policy Priorities. Retrieved from https://www.cbpp.org/research/family-income-support/policy-brief-tanf-reaching-few-poor-families

2 Falk, K. (2017). Temporary Assistance for Needy Families (TANF): Size of the Population Eligible for and Receiving Cash Assistance. Washington, D.C.: Congressional Research Service. Retrieved from https://fas.org/sgp/crs/misc/R44724.pdf

3 Characteristics and Financial Circumstances of TANF Recipients. (2019). Washington, D.C.: Administration for Children & Families, Office of Family Assistance. Retrieved from https://www.acf.hhs.gov/ofa/news/ofa-releases-latest-characteristics-and-financial-circumstances-of-tanf-recipients-data-1#:~:text=On%20average%2C%20TANF%20recipient%20families%20received%20

4 2018 Poverty Guidelines. (2018). Washington, D.C.: U.S. Department of Health & Human Services, Office of the Assistant Secretary for Planning and Evaluation. Retrieved from https://aspe.hhs.gov/2018-poverty-guidelines

5 Hispanic Heritage Month 2019. (2019). Suitland, MD: United States Census Bureau. Retrieved from https://www.census.gov/newsroom/facts-for-features/2019/hispanic-heritage-month.html

6 Child population by race in the United States. (n.d). Baltimore, MD: Annie E. Casey Foundation, Kids Count Data Center. Retrieved from https://datacenter.kidscount.org/data/tables/103-child-population-by-race?loc=1&loct=2#detailed/1/any/fase/37,871,870,573,869,36,868,867,133,38/68,69,67,12,70,66,71,72/423,424

7 Ryberg, R., Guzman, L. A National Portrait of Hispanic Children in Need: 2020 Update (forthcoming). Bethesda, MD: National Research Center on Hispanic Children & Families.

8 Hahn, H., Aron, L., Lou, C., Pratt, E., & Okoli, A. (2017). Why does Cash Welfare Depend on Where You Live? Washington, D.C.: Urban Institute. Retrieved from https://www.urban.org/sites/default/files/publication/90761/tanf_cash_welfare_final2_1.pdf

9 Clarke, W., Turner, K., & Guzman, L. (2017). One Quarter of Hispanic Children in the United States Have an Unauthorized Immigrant Parent. Bethesda, MD: National Research Center on Hispanic Children & Families. Retrieved from https://hispanicrescen.wpengine.com/wp-content/uploads/2019/08/Hispanic-Center-Undocumented-Brief-FINAL-V21.pdf

10 Turner, K., Guzman, L., Wildsmith, E., & Scott, M. (2015). The Complex and Varied Households of Low-Income and Hispanic Children. Bethesda, MD: National Research Center on Hispanic Children & Families. Retrieved from https://hispanicrescen.wpengine.com/wp-content/uploads/2019/08/Household-Complexity-Brief-V21.pdf

11 Flores, A., Lopez, G., & Radford, J. (2015). Statistical portrait of Hispanics in the United States. Washington, D.C.: Pew Research Center, Hispanic Trends. Retrieved from https://www.pewresearch.org/hispanic/2017/09/18/2015-statistical-information-on-hispanics-in-united-states-current-data/

12 Gennetian, L., Mendez, J., & Hill, Z. (2019). How State-level Child Care Development Fund Policies May Shape Access and Utilization among Hispanic Families. Bethesda, MD: National Research Center on Hispanic Children & Families. Retrieved from https://hispanicrescen.wpengine.com/wp-content/uploads/2019/11/Hispanic-Center-CCDF-brief-FINAL1.pdf

13 Clarke, W., Turner, K., & Guzman, L. (2017).

14 Children who live in two-parent families, by race ethnicity in the United States. (n.d). Baltimore, MD: Annie E. Casey Foundation, Kids Count Data Center. Retrieved from https://datacenter.kidscount.org/data/tables/8053-children-who-live-in-two-parent-families-by-race-ethnicity#detailed/1/any/false/1491,1049/4217,4218,4215,3301,4216,2664/15474,1547313

15 Turner, K., Guzman, L., Wildsmith, E., & Scott, M. (2015).

16 Artiga, S., Orgera, K. (2020). Changes in Health Coverage by Race and Ethnicity since the ACA, 2010-2018. San Francisco, CA: Kaiser Family Foundation, Disparities Policy. Retrieved from https://www.kff.org/disparities-policy/issue-brief/changes-in-health-coverage-by-race-and-ethnicity-since-the-aca-2010-2018/

17 Clarke, W., Turner, K., & Guzman, L. (2017).

18 Ibid.

19 Gennetian, L., Mendez, J., & Hill, Z. (2019).

20 TANF and MOE Spending and Transfers by Activity, FY2018 (Contains National & State Pie Charts). (2019). Washington, D.C.: Administration for Children and Families, Office of Family Assistance. Retrieved from https://www.acf.hhs.gov/ofa/resource/tanf-and-moe-spending-and-transfers-by-activity-fy-2018-contains-national-state-pie-charts

21 TANF Caseload Data 2018. (2019). Washington, D.C.: Administration for Children and Families, Office of Family Assistance. Retrieved from https://www.acf.hhs.gov/ofa/resource/tanf-caseload-data-2018

22 Policy Basics: Temporary Assistance for Needy Families. (2020). Washington, D.C.: Center on Budget and Policy Priorities. Retrieved from https://www.cbpp.org/research/family-income-support/temporary-assistance-for-needy-families

23 McDaniel, M., Woods, T., Pratt, E., & Simms, M.C. (2017). Identifying Racial and Ethnic Disparities in Human Services: A Conceptual Framework and Literature Review. OPRE Report #2017-69. Washington, D.C.: Office of Planning, Research and Evaluation, Administration for Children and Families, U.S. Department of Health and Human Services. Retrieved from https://www.urban.org/sites/default/files/publication/94986/identifying-racial-and-ethnic-disparities-in-human-services_1.pdf

24 Goehring, B., Heffernan, C., Minton, S., & Giannarelli, L. (2019). Welfare Rules Databook: State TANF Policies as of July 2018. OPRE Report 2019-83. Washington, D.C.: Office of Planning, Research, and Evaluation, Administration for Children and Families, U.S. Department of Health and Human Services. Retrieved from https://www.urban.org/research/publication/welfare-rules-databook-state-tanf-policies-july-2018

25 Clarke, W., Turner, K., & Guzman, L. (2017).

26 Children who live in two-parent families, by race ethnicity in the United States. (n.d).

27 Hahn, H., Giannarelli, L., Kassabian, D., & Pratt, E. (2016). Assisting Two Parent Families Through TANF. OPRE Report #2016-56. Washington, D.C.: Office of Program Evaluation and Research, Administration for Children and Families, U.S. Department of Health and Human Services. Retrieved from https://www.urban.org/sites/default/files/publication/81851/2000837-Assisting-Two-Parent-Families-Through-TANF.pdf

28 Turner, K., Guzman, L., Wildsmith, E., & Scott, M. (2015).

29 Ibid.

30 Health of Hispanic or Latino Population, National Center for Health Statistics. (n.d.) Atlanta, GA: Center for Disease Control and Prevention. Retrieved from https://www.cdc.gov/nchs/fastats/hispanic-health.htm

31 Taylor, P., Lopez, M. H., Martinez, J., & Velasco, G. (2012). Language Use among Latinos. Washington D.C.: Pew Research Center. Retrieved from https://www.pewresearch.org/hispanic/2012/04/04/iv-language-use-among-latinos/

32 Clarke, W., Turner, K., & Guzman, L. (2017).

33 Ibid.

34 Neubeck, K.J., Cazenave, N.A. (2002). Welfare racism: Playing the race card against America’s poor. New York, NY: Routledge. Retrieved from https://scholarworks.wmich.edu/cgi/viewcontent.cgi?article=2890&context=jssw

35 Burnham, L. (2007). Racism in United States welfare policy. Race, Poverty & the Environment, 14(1), 47-50.

36 Falk, G., McCarty, M., & Aussenberg, R.A. (2016). Work Requirements, Time Limits, and Work Incentives in TANF, SNAP, and Housing Assistance. Congressional Research Service, 9.

37 Update: The United States Is Continuing to Lead the Response to COVID-19. (2020). Washington, D.C.: U.S. Department of State, Office of the Spokesperson. Retrieved from https://2017-2021.state.gov/update-the-united-states-is-continuing-to-lead-the-response-to-covid-19/index.html

38 Oppel Jr., R.A., Gebeloff, R., & Lai, K.K. (2020). The Fullest Look Yet at the Racial Inequity of Corona Virus. New York, NY: New York Times. Retrieved from https://www.nytimes.com/interactive/2020/07/05/us/coronavirus-latinos-african-americans-cdc-data.html

Acknowledgements

The authors would like to thank the Steering Committee of the National Research Center on Hispanic Children & Families and Marianne Bitler, Randall Capps, Rashmita Mistry, Lina Guzman, and Ann Rivera for their feedback on earlier drafts of this brief, as well as Jenna Castillo and Melissa Perez for their research assistance at multiple stages of this project.

Editor: Brent Franklin

Designer: Catherine Nichols

About the Authors

Lisa Gennetian, PhD, is a co-investigator of the National Research Center on Hispanic Children & Families, leading the

research area on poverty and economic self-sufficiency. She is the Pritzker Associate Professor of Early Learning Policy

Studies at Duke University Sanford School of Public Policy. One of her research foci is income instability among children

and families, the ways this is informed by theories emerging from behavioral economics, and implications for social policy

and programs.

Zoelene Hill, PhD, is a Research Scientist at Child Trends in the Early Childhood Division. Her areas of expertise include

policies in early childhood education, workforce development, and family engagement. Dr. Hill was a fellow with the

National Research Center on Hispanic Children & Families in the early care and education research area.

Dakota Ross-Cabrera, MA, is currently a doctoral student in Sociology at the Graduate Center, CUNY. Her research

interests focus on race and second-generation Latinx identity formation and minoritization during postsecondary education.